How to make a small fortune investing in life insurance

Life Insurance as an Asset

Life insurance companies have presented some permanent life insurance products as a “tax-advantaged asset class”.

Do the ‘tax advantages’ of accumulating cash values outweigh the fees, expenses, and risks?

First let’s take a look at the most promoted advantages: tax-deferred growth.

tax deferred growth

While it may be truthful to say that ‘cash values within life insurance accumulate tax-deferred’, it can also be misleading to the consumer because what is “invested” is net of fees and expenses. This may mean that only a small percentage of what was paid as premium is accumulating tax free.

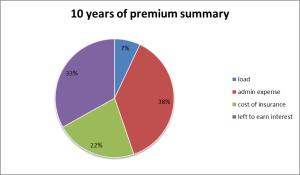

Here is ten year summary from a recent illustration:

- based on a male age 48 standard non-tobacco,

- illustrating a level death benefit of $1,000,000.00

- endowing at age 121

- paying $7914 annually

- $79140 in premiums $52939 covered the costs and fees (load, admin, COI)

- The result is that during the first 10 years only one in three premium dollars is going to accumulate at the tax-advantaged rate.

I repeat – only one third of premiums will be ‘invested’ during the first 10 years. Based on my compound interest calculator they would have to earn around 20% per year just to break even.

Is this an investment? – you decide.

So as the joke goes: How do you make a small fortune investing in life insurance – start with a large fortune.

request more informationNext up: tax free withdrawals at retirement.